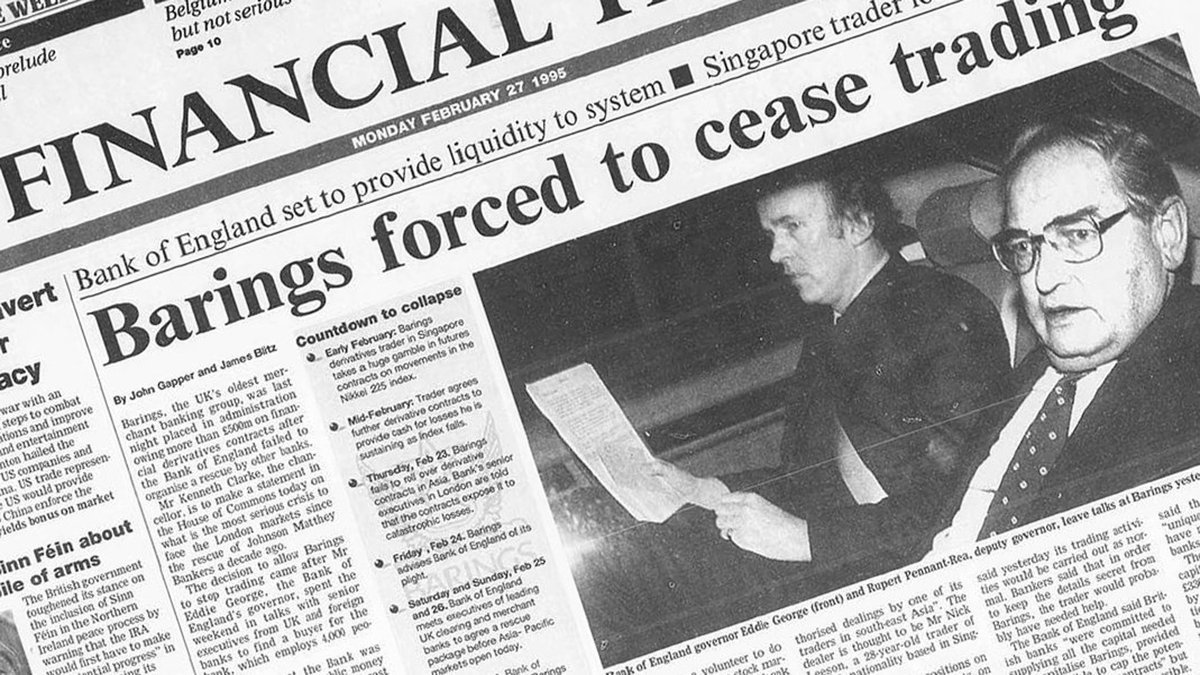

By jesse colombo this article was written on march 15th 2005 in february of 1995 one man single handedly bankrupted the bank that financed the napoleonic wars louisiana purchase and the erie canal.

Barings bank failure.

With offices on four continents we maintain a local presence in several strategic locations gaining deep insights and detailed knowledge in these important markets.

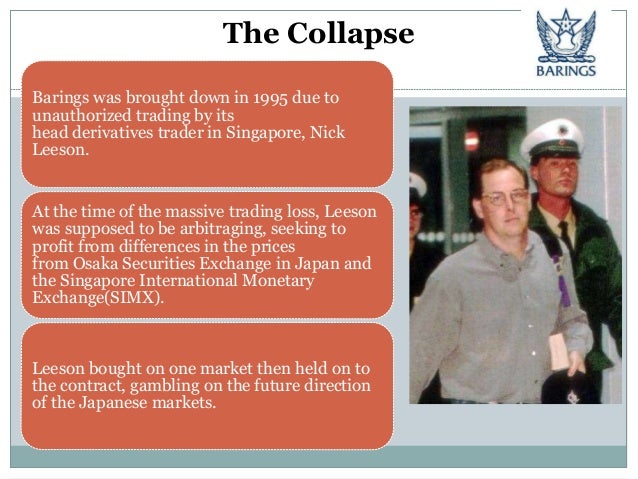

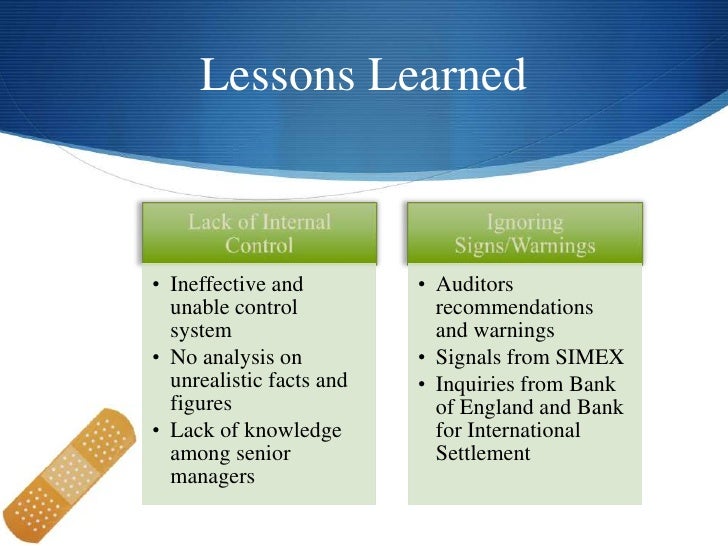

The first case was revealed in the early 1990 s where the infamous rogue trader nick leeson brought about the collapse of the uk s barings bank.

Founded in 1762 barings bank was britain s oldest merchant bank and queen elizabeth s personal bank.

Nick leeson is a former derivatives trader who became notorious for bankrupting barings bank the united kingdom s oldest merchant bank in 1995.

Barings s investors also lost out.

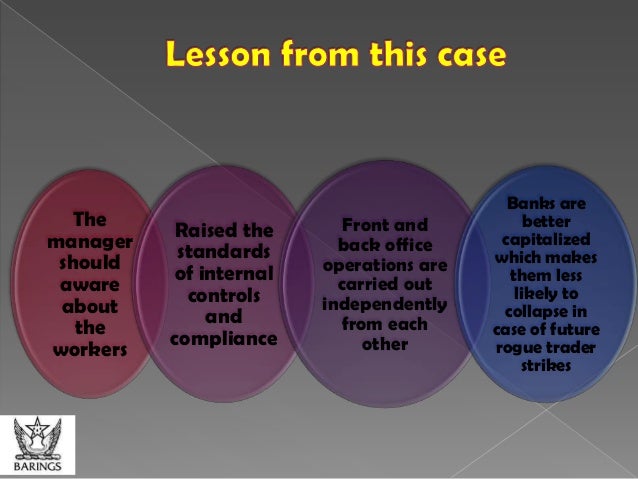

Once a behemoth in the banking industry barings was brought to its knees by a rogue trader in a singapore office.

The bank collapsed in 1995 after suffering losses of 827 million 1 6 billion in 2019.

Barings bank was a british merchant bank based in london and the world s second oldest merchant bank after berenberg bank baring s close collaborator and german representative it was founded in 1762 by francis baring a british born member of the german british baring family of merchants and bankers.

Barings has established a global footprint to help us uncover and provide access to a superior range of investment opportunities.

After opening a future and options office in.

Barings having lost over.

Judith rawnsley who worked for barings bank and later wrote a book about the leeson case proffered three explanations for leeson s behavior once the losses had started to pile up.

Barings bank was founded in 1762 by francis baring a british born member of the famed german family of merchants and bankers.

Barings was england s oldest merchant bank.

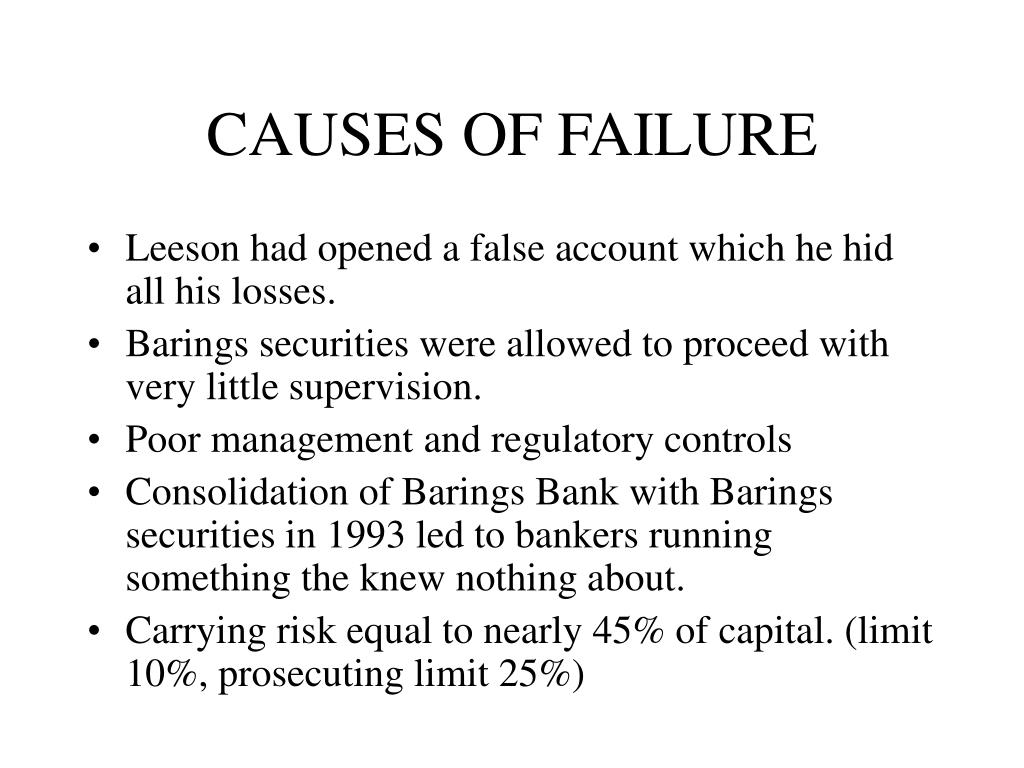

1 leeson s loss aversion stemmed from his fear of failure and humiliation.

The collapse of barings bank in february 1995 was caused by colossal losses incurred by a single rogue trader.

It financed the napoleonic wars and the louisiana purchase and helped finance the united states government during the war of 1812.

3 he suffered from common distortions in thinking patterns that often result from high levels of stress including overconfidence and denial.

As for barings it become part of ing the dutch bank paying 1 00 for it in 1995.

From achieving the recognition of barings bank s star singapore trader declaring himself as the rising star leeson also caused the bank s greatest downfall in 1995.

Nick leeson the collapse of barings bank.

Many of leeson s former colleagues lost their jobs.

2 his ego and greed were exacerbated by the macho trading environment in which he operated.